There are a number of things going on that, while not actually alarming, are making me uneasy about being fully invested at this point. In no particular order: The collapsing housing bubble, negative savings rate, understated inflation, dollar instability, federal and current account deficits. There is more, but I'll save all that for later posts.

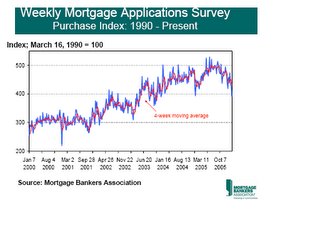

For right now though, (just to have some substance today) here's an unsettling chart: The header says 1990-present, even though the x-axis shows 2000-present. What's worrisome is the drop-off at the end, and the implications for consumer spending through refi home equity extraction.

For right now though, (just to have some substance today) here's an unsettling chart: The header says 1990-present, even though the x-axis shows 2000-present. What's worrisome is the drop-off at the end, and the implications for consumer spending through refi home equity extraction.I don't believe that home equity extraction is good (the opposite, in fact) but it seems to have been the only thing propping up an otherwise anemic economy.

That's it for right now though... I just got off work and rode home on a chilly morning, and so my fingers don't want to work very well at the moment! :)

No comments:

Post a Comment